Taxation of long term capital Gains:

As mentioned earlier, unlike interest on Fixed deposits, which is taxed each year on an accrual basis,

in a debt Mutual fund, the gains will be taxed only at the time of withdrawal. This essentially means, you are liable to pay tax only (if) after you withdraw from the fund, now let me explain how this works with an example.

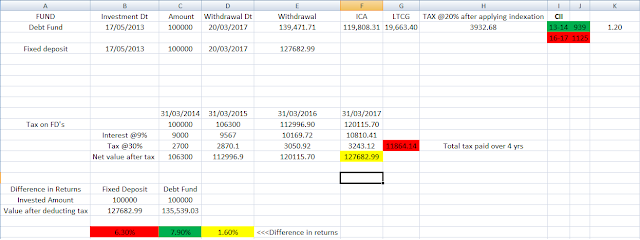

In the above image, you can clearly see that this investment was done in May 2013 and withdrawn in March 2017, this means that, I am not liable to pay any tax for the financial years ending 31st March 2014, 31st March 2015, 31st March 2016, simply because, while interest from Fixed Deposits is directly added to your overall income, Gains from Debt MF's come under the purview of Capital Gains.

Now as per the Income tax Act, all gains from Debt Mutual funds whose holding period is 36 months or more are classified as long term capital gains. So in this case here is what will happen:

Since I have redeemed after completion of 36 months I need to first need to calculate the indexed cost of acquisition(ICA) for which I will need the cost inflation index of both the years i.e the year in which the investment was made and the year in which it was withdrawn. The cost inflation index is notified by the income tax department each year and is available in this link.

Step 1. In my case the ICA is Rs,1,19,808.31/- which means my inflation adjusted cost of investing in the particular debt fund was not Rs.1,00,000/- but 1,19,808.31.

Step 2. Once you calculate the ICA you have to simply subtract it from the Withdrawal amount to arrive at the Long Term Capital Gain (LTCG)

Step 3. Calculate tax applicable which in this case is 20%

Step 4. Subtract tax amount from withdrawal amount to arrive at your Net Value

Thats it....

(For a detailed calculation please drop me an email on ninadkamatcfp@gmail.com)

We can clearly see that, there is a difference of 1.6% in returns between FD's and debt funds. Now to put this into perspective over the long term, even if you do not invest in Equities considering that you are Risk Averse, a mere 1.6% difference in returns over 10 years in your investment means you have earned about 16% more returns by just switching to a product in the same asset class.

*The tax calculation is for demystifying returns on products discussed above, please consult your Chartered Accountant/Tax Consultant for your personal tax implications as they are most qualified to asses your Tax Situation.

Image source: Income tax website

Fund is mentioned for illustration purpose only. Please consult your financial adviser before investing.

In the above image, you can clearly see that this investment was done in May 2013 and withdrawn in March 2017, this means that, I am not liable to pay any tax for the financial years ending 31st March 2014, 31st March 2015, 31st March 2016, simply because, while interest from Fixed Deposits is directly added to your overall income, Gains from Debt MF's come under the purview of Capital Gains.

Now as per the Income tax Act, all gains from Debt Mutual funds whose holding period is 36 months or more are classified as long term capital gains. So in this case here is what will happen:

Since I have redeemed after completion of 36 months I need to first need to calculate the indexed cost of acquisition(ICA) for which I will need the cost inflation index of both the years i.e the year in which the investment was made and the year in which it was withdrawn. The cost inflation index is notified by the income tax department each year and is available in this link.

Step 1. In my case the ICA is Rs,1,19,808.31/- which means my inflation adjusted cost of investing in the particular debt fund was not Rs.1,00,000/- but 1,19,808.31.

Step 2. Once you calculate the ICA you have to simply subtract it from the Withdrawal amount to arrive at the Long Term Capital Gain (LTCG)

Step 3. Calculate tax applicable which in this case is 20%

Step 4. Subtract tax amount from withdrawal amount to arrive at your Net Value

Thats it....

(For a detailed calculation please drop me an email on ninadkamatcfp@gmail.com)

Think about it......

*The tax calculation is for demystifying returns on products discussed above, please consult your Chartered Accountant/Tax Consultant for your personal tax implications as they are most qualified to asses your Tax Situation.

Image source: Income tax website

Fund is mentioned for illustration purpose only. Please consult your financial adviser before investing.

No comments:

Post a Comment